- RockWater Roundup

- Posts

- Wpromote Buys Giant Spoon // Creates New Full-Funnel Agency

Wpromote Buys Giant Spoon // Creates New Full-Funnel Agency

M&A and strategy insights for creator economy. We help you build and invest better.

“RockWater’s newsletter is the Wall Street Journal of the Creator Economy” — Brendan Gahan, CEO of Creator Authority

Welcome to our 13,000+ readers!

If you're not yet a subscriber, sign up here for the most widely-read newsletter on M&A and strategy insights for the creator economy and social agencies.

Hi readers,

Last night we hosted our RockWater holiday party in NYC. It was a blast, and imo one of our best events yet!

Thanks to all who showed up and brought great energy. I’ll share photos on my Linkedin next week.

Today we discuss Wpromote’s acquisition of Giant Spoon, a creative media and experiential agency. We analyze deal details, strategic rationale, deal origin story, full-funnel agency consolidation, owner ZMC’s future agency playbook, growing M&A for experiential services, and why the banker-less deal is an anomaly.

Other quick hits before we dive into the deal analysis down below…

UPCOMING EVENTS

1BF exec party in Dubai on Sat Jan 10

Night Before SoCom party in Santa Monica on Wed Feb 25

SXSW party in Austin, prob March 12 or 13

HIRING

We seek PT employees-in-training for M&A advisory; our next cohort starts mid January. DM me if interested

COMPANIES FOR SALE NOW

Large global creator e-learning & monetization co | $5M EBITDA

Social channel portfolio x CPG | (in exclusivity)

Social x live agency in APAC | 10 yr history

Digital talent mgmt x music | $3M EBITDA

IM x talent mgmt in CA | $6.6M revenue

Prod x talent co in APAC | < $1M EBITDA

Creator partnerships agency | < $1M EBITDA

…DM me for the CIMs

UPCOMING SALES

Digital courses biz, entrepreneurship focus

IM and social commerce SaaS co

Digital media sales co in CA

Digital talent co on east coast

IM SaaS co in NYC

…new sell-side clients coming soon, stay tuned

…DM me to get on buyers list via [email protected]

How RockWater can help you → DM me if you’re a creator economy or digital / audio agency co and need M&A or strategy help.

Onward,

Chris, Founder of RockWater

Wpromote Buys Giant Spoon // Creates New Full-Funnel Agency

By Chris Erwin

Let’s break it down…

–SELLER: Giant Spoon–

Overview

Creative media and experiential agency

“The agency that stirs shit up”

Specializes in culture-defining ideas and large-scale brand activations

Founded by Jonathan Haber, Marc Simons, Trevor Guthrie, and Alan Cohen in 2013

123+ associated members via LI

Based in LA and NY

Founding Story

Founded by team of veterans from OMD, a subsidiary of Omnicom Group, and Alan Cohen, former President of Initiative, a subsidiary of Interpublic Group

Saw limits of traditional models in world where consumers could easily skip ads

Launched Giant Spoon to integrate creative and media strategy

Early clients include General Electric, HP, and NBC

Helped establish agency’s reputation for high-impact campaigns

Company Highlights

Recipient of 2024 Independent Agency Of The Year award, and 2022 Creative Agency Of The Year

Known for high-profile, culture-defining campaigns for HBO (House of the Dragon Empire State Building wrap) and produced Gravity SUV campaign for Lucid Motors

Managed $1B+ of ad spend

Business Lines / Model

Media…

Planning and buying focused on performance, innovation, custom partnerships, and sponsorships

Strategy…

Defining brand positioning, architecture, and competitive analysis through audience personas

Creative & Design…

Full-service creation: campaign development, motion graphics, editing, and art direction

Content & Marketing…

Disciplines covering social strategy, paid media, and influencer strategy

Experiential…

End-to-end event production, venue sourcing, and fabrication management

Capital Markets History

Nov ‘25 Acquired by Wpromote

–BUYER: Wpromote–

Overview

Independent, full-funnel digital marketing agency focused on performance media and data-driven solutions

Founded by Michael Mothner in 2001

684 Associated Members on LI

Based in LA

Founding Story

Started in 2001 as Dartmouth side project; a script to get small businesses visible on search engines

Shifted focus to lucrative Paid Search (PPC), allowing founder to skip investment banking for entrepreneurship

Expanded scope to address the full digital ecosystem, adding services like Paid Social, Email / Lifecycle Marketing, and Digital Experience

Accelerated growth and expertise through strategic acquisitions (e.g., Metric Digital), building out capabilities in e-commerce, advanced analytics, and performance creative

Company Highlights

Manages $3B+ in media spend for enterprise and challenger brands including Peacock, Vuori, and TransUnion

Proprietary intelligence platform, Polaris IQ, provides predictive forecasting and data insights

Ad Age's 2025 Performance Marketing Agency of the Year

Business Lines

Paid Media…

Paid Search, Paid Social, Programmatic, CTV, Amazon & Retail Media

Earned and Owned Media…

SEO, Content Marketing, Influencer Marketing, Digital Experience

Digital Intelligence…

Data Science, Attribution & Analytics, Measurement Strategy, Conversion Rate Optimization (CRO)

Capital Markets History

Nov ‘25 Acquired Giant Spoon, a creative media-experiential agency

Mar ‘20 Acquired Metric Digital, a digital marketing agency

–DEAL DETAILS–

Overview

Announced November 25, 2025

Undisclosed amount

Deal Origin Story

The below is based on the In/organic podcast co-hosted by WP’s head of M&A Christian Hassold…

In Sep 2024 WP hired a new head of corporate development, Christian Hassold, who has been an operating partner for owner ZMC since 2022

Hassold was given an M&A target list of 100+ digital marketing names

Hassold realized he needed a clear M&A strategy to guide the outreach plan, and defined one with WP leadership

Then target outreach began to 100+ agency owners

WP’s first meeting with Giant Spoon cofounders was about year ago over a cup of tea in LA

As WP narrowed its strategic short list of agencies to acquire, talks with Giant Spoon accelerated

Giant Spoon opted not to hire a banker

Wpromote relied on its PE owner, ZMC, to support the deal process (I write more about this below)

Giant Spoon designated one if its 3 cofounders as its lead deal liaison, and also leveraged GS’s experienced CFO

The acquisition took approximately six months to close once deal talks meaningfully picked up

Strategic Rationale

Merges Giant Spoon’s creative storytelling with Wpromote’s data-backed performance marketing into a unified full agency funnel

Wpromote adds robust analytics, media-buying infrastructure, and performance measurement tools to optimize Giant Spoon’s campaigns

Positions the combined agency to compete with larger integrated ad networks (e.g. newly merged Omnicom x IPG) by offering both bold creative and data-driven performance, while retaining independent agility

Giant Spoon brings high-profile entertainment, lifestyle, and tech clients, along with award-winning creative teams

Giant Spoon’s co-founders (Haber, Simons, Guthrie) integrate into Wpromote’s executive team, preserving creative leadership while scaling operations

“The best brands in the world understand that both brand and performance are essential to success,” stated Bendzick. “Where we’re changing the game is by providing a truly seamless approach, where media, creative, data, and full-funnel strategy are deeply integrated, not just co-existing.”

“Bringing Wpromote and Giant Spoon together allows us to connect the impact of big ideas all the way to our clients’ bottom line.” said Jonathan Haber, co-founder of Giant Spoon

Post-Deal Operations

Giant Spoon and Wpromote continue operating under their respective brands while integrating key support functions

The combined Wpromote × Giant Spoon business will be led by Wpromote CEO Andrea Bendzick, with Giant Spoon’s co-founders Jonathan Haber, Marc Simons, and Trevor Guthrie joining the executive leadership team to help guide strategy and operations

Integration efforts focus on aligning internal processes, data systems, and campaign workflows to support collaboration while maintaining creative and performance standards

–WHAT ELSE I FIND INTERESTING–

The ZMC Question: Is Wpromote Now the Private Equity Firm's 'Tentpole'?

Private equity firm Zelnick Media Capital (ZMC) bought digital-performance heavyweight Wpromote in 2022. The recent acquisition of creative media shop Giant Spoon cements Wpromote's push into a full-funnel agency model — and raises a question: Is Wpromote becoming ZMC's most important marketing asset, or "tentpole," around which the rest of the portfolio might consolidate?

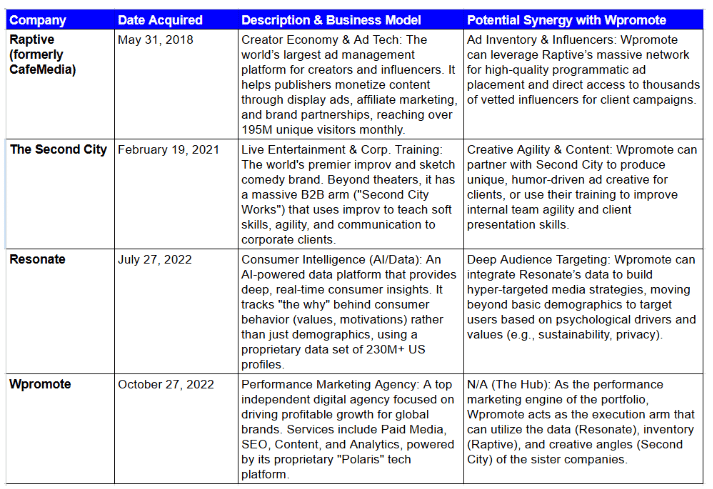

To that point, ZMC owns a strategic, modern suite of media, marketing, and entertainment assets acquired primarily in the last five years. See exec summary of these assets in table below:

The PE Playbook: Grow or Sell?

The tight cluster of these acquisitions — all occurring in a four-year window — could suggest a strategy focused on building a modern, tech-enabled marketing ecosystem. Or, ZMC sees value in various parts of the marketing value chain and made some strategic bets, and now is figuring out where to double down.

The decision now pivots between two classic private equity scenarios:

The Integration Path ("Buy and Build"): Wpromote's accelerating growth suggests ZMC will invest heavily in the company, bringing in the specialized resources of its other businesses, like Resonate's data or Raptive's creator network, to build a truly integrated, challenger agency. This strategy uses the platform company to achieve rapid scale by combining related operations.

The Focus and Sell Strategy: Conversely, if Wpromote proves to be the standout performer, ZMC may choose to sell off businesses that are less aligned or that have reached maximum value. This frees up capital and management focus, allowing ZMC to put all its energy into scaling Wpromote for a much larger and more profitable future sale.

As it specifically relates to ZMC, my understanding is that they underwrite each company acquisition as a viable standalone business. If there are ways for portfolio companies to work together, the ZMC team will facilitate intros between leadership and the sharing of info. But, they won’t play sides to force a deal – they leave that up to the principals of their portfolio companies.

Overall, private equity firms are highly adept at both combining operations for efficiency, and strategically selling assets to concentrate on the biggest winners. Curious to see where this strategy nets out for the above segment of the ZMC marketing x media portfolio.

Why Wpromote is Buying Experience: The Data Behind the New Attention Playbook

The strategic rationale behind the Wpromote x Giant Spoon includes three key points:

The Attention Crisis Solution: The old media playbook is broken. With fragmented attention and endless digital noise, marketers must create unmissable cultural "tentpole" moments. This is why 74% of Fortune 1000 marketers are now betting on experiential, planning to increase budgets next year for live, in-real-life (IRL) events.

Physical Moments Drive Digital Scale: Marketers must create moments in the physical world that are engineered to be shared, and that can drive high organic reach and fan engagement. This is increasingly a way to help brands cut through the noise, especially in the creator economy, where 41% of US social media users attended a creator or fan event last year. Youth consumers desire meaningful connection outside of digital environments; as a result, content on social feeds that showcase touchstone irl moments often benefit from more algorithm support. Case in point, the Sam & Colby escape room drove over 25M YouTube video views and sold out eight weeks of bookings after launch.

ROAS Rationale – Performance Marketing Magnifies the Moment: Wpromote is expert at performance marketing and media amplification. This means Wpromote’s paid media strategies ensure content from these cultural moments achieve maximum yet efficient reach. The result is efficient digital distribution and better Return on Ad Spend (ROAS), a key metric for an agency’s brand marketer clients.

Why the Banker-Less Giant Spoon Deal is an Anomaly

Wpromote’s acquisition of Giant Spoon was done in-house, without external bankers – it’s a testament to the internal dealmaking muscle between the buyer and seller, which includes WP’s financial backer ZMC, WP’s head of M&A who was previously an operating partner at ZMC, and an experienced CFO at Giant Spoon.

Here’s something I found interesting → Wpromote’s Head of Corporate Development, Christian Hassold, said on his In/organic podcast that he contacted bankers as a professional courtesy on the morning of the announcement. As would be expected, firms like ZMC and Wpromote have likely been building relationships with various bankers for years, and have likely partnered with some of those bankers on past deals.

Therefore, it was savvy of Christian to do the outreach, since those bankers were likely frustrated they weren’t included on the deal after years of client relationship building, and specifically the chance to earn a large fee (I personally know that feeling well!). But Christian knows it’s important to keep those bankers happy to ensure continued deal flow opportunities to their firm, and to have those banker relationships warm when it’s time to potentially partner up on other deal opportunity.

That’s smart long term thinking by a corp dev team.

I also appreciated what Christian shared on his podcast about why it often makes sense for founders and business leaders to work with bankers as deal advisors, particularly in the complex world of marketing and ad agency M&A.

Which implies that this deal was an outlier.

In most complex agency M&A, bankers are critical deal team leaders do much more than just connect sellers to buyers. For example, they help normalize financials, including standardizing how agency client retainer and project fees, and related servicing costs, are recognized over multiple months or years. This helps to establish true profitability of the agency, which is critical to defining the financial health of the business, growth potential, and the right valuation and deal structure to bring both buyer and seller together..

Beyond financials, bankers drive process efficiency: they advise on market-standard terms, bridge negotiation gaps with creative solutions, and drive the transaction to close through their success-based fee structure.

The Giant Spoon deal proved a clean combination could happen without a banker. But for most complex agency acquisitions, an experienced banking advisor will materially accelerate and improve the likelihood of a successful outcome for both buyer and seller. That’s what we pride ourselves on at RockWater.

This Wpromote x Giant Spoon Combination Makes Us Think of Two Other Recent Deals in the Experience Economy

Night acquires Experiential Supply: We saw a similar deal strategy when Night, a top creator management firm, acquired Experiential Supply, an event production house (our deal analysis). Night CEO Reed Duchscher saw the acquisition as the "increasing anchor for brand services," providing the essential physical event layer needed to unlock massive six- and seven-figure studio-level digital campaigns for their creator and brand clients.

Fever acquires DICE: This strategy of vertically integrating physical experience with digital monetization is a broader market theme. We also saw it in the live-events sector when media and events company Fever bought ticketing platform DICE to own the entire value chain—from content discovery and promotion to ticketing and audience data—to become a full-stack experience platform (our deal analysis).

Creative Agencies as “Tip of the Spear”; A Wedge into More Brand Dollars

Modern digital-focused ad agencies utilize creative services as a strategic wedge to capture more brand dollars. This shift is evident in the commercial and M&A strategies of challenger ad networks like Stagwell (our deal analysis), Acceleration Group of Companies, and SAMY Alliance (our deal analysis), and in the expansion of consulting companies into agency services, like Accenture Song’s acquisition of digital creative firm Superdigital (our deal analysis).

This approach relies on a classic "hub and spoke" agency model: by establishing the initial client relationship through high-touch creative strategy, the agency can effectively cross-sell execution services to the end client.

This structure drives higher account revenue volume and longer-term retention by establishing multiple touchpoints across the broader agency team. In this context, Giant Spoon becomes the "tip of the spear" for Wpromote—a primary landing point for WPromote’s existing and prospective brand marketer clients. The integration of GS also creates a viable pathway to introduce more marketing services by Wpromote, and to integrate future capabilities for clients acquired through future M&A.

There’s also a parallel here to Hollywood and the entertainment industries, which I heard from an industry dealmaker. “The closer one is to the original content idea and strategy, the more it allows one to dictate the direction of a project or campaign, and the harder it is to be ripped out of the project.”

Makes total sense.

Full-Funnel Agency Consolidation

Wpromote’s acquisition of Giant Spoon highlights a broader trend of agencies merging creative and performance capabilities into full-funnel solutions.

This result is continued industry-wide consolidation: recent mergers include Barkley + OKRP (Mar 2024), Empower + MediaOcean (Sep 2025), and Horizon Media + Havas (Sep 2025), all aimed at unifying creative, media, and analytics capabilities

The combined Wpromote x Giant Spoon business, managing $3B+ in media spend, now offers clients integrated strategy, creative, and measurement while retaining independent agility. This trend reflects growing demand from brands for agencies that can deliver both attention-grabbing creative and measurable performance, bridging traditional creative and performance marketing silos.

(Thanks to Marketing Dive for the insights on these 3 other recent agency deals)

I'm the founder of RockWater Industries. We do M&A and strategy advisory for creator economy and social / audio agencies. From buy and sell-side M&A and fundraising to market research and go-to-market planning.

DM me on LinkedIn or email [email protected]

📖 More RockWater Reads 📖

Amaze Pays $650k for The Food Channel // Doubles Down on Culinary Creators (link)

Fox Buys Meet Cute // Goes on Deal Spree in Creator x Podcasting (link)

Puck Pays $16M for Air Mail // Rise of Journalist-led Newsletters (link)

Steven.com Gets $425M Valuation // Building the Disney of the Creator Economy (link)

Night Acquires Experiential Supply // Pursues $100B+ Market in Creator x Events (link)

💲 Help Us Help You 💲

We've paid tens of thousands of dollars in referral fee.

We offer 5-15% of gross revenue depending on project size and extent of referral support.

If you know of a business leader in your network who could benefit from our help, reach out to me at chris@wearerockwater.com

🤝Our Partners 🤝

We advise companies from the Fortune 50 to pre-seed startups.

☎️ Want to learn more about our services? ☎️

Reach out to me at [email protected]

Check out all our content here